Which Type of Account Is Increased With a Credit

Trade Credit A trade credit is an agreement or. To increase revenue accounts credit the corresponding sub-account.

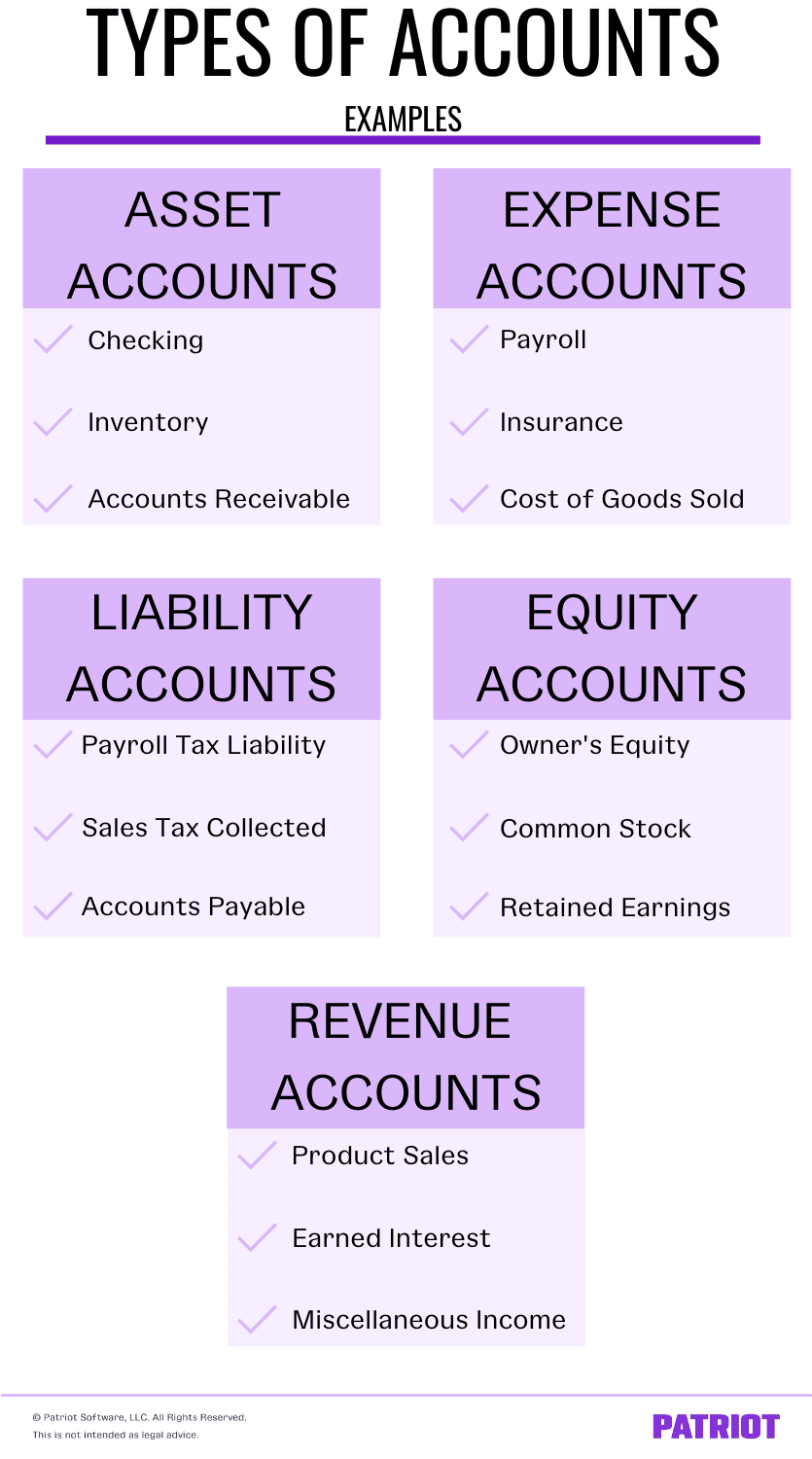

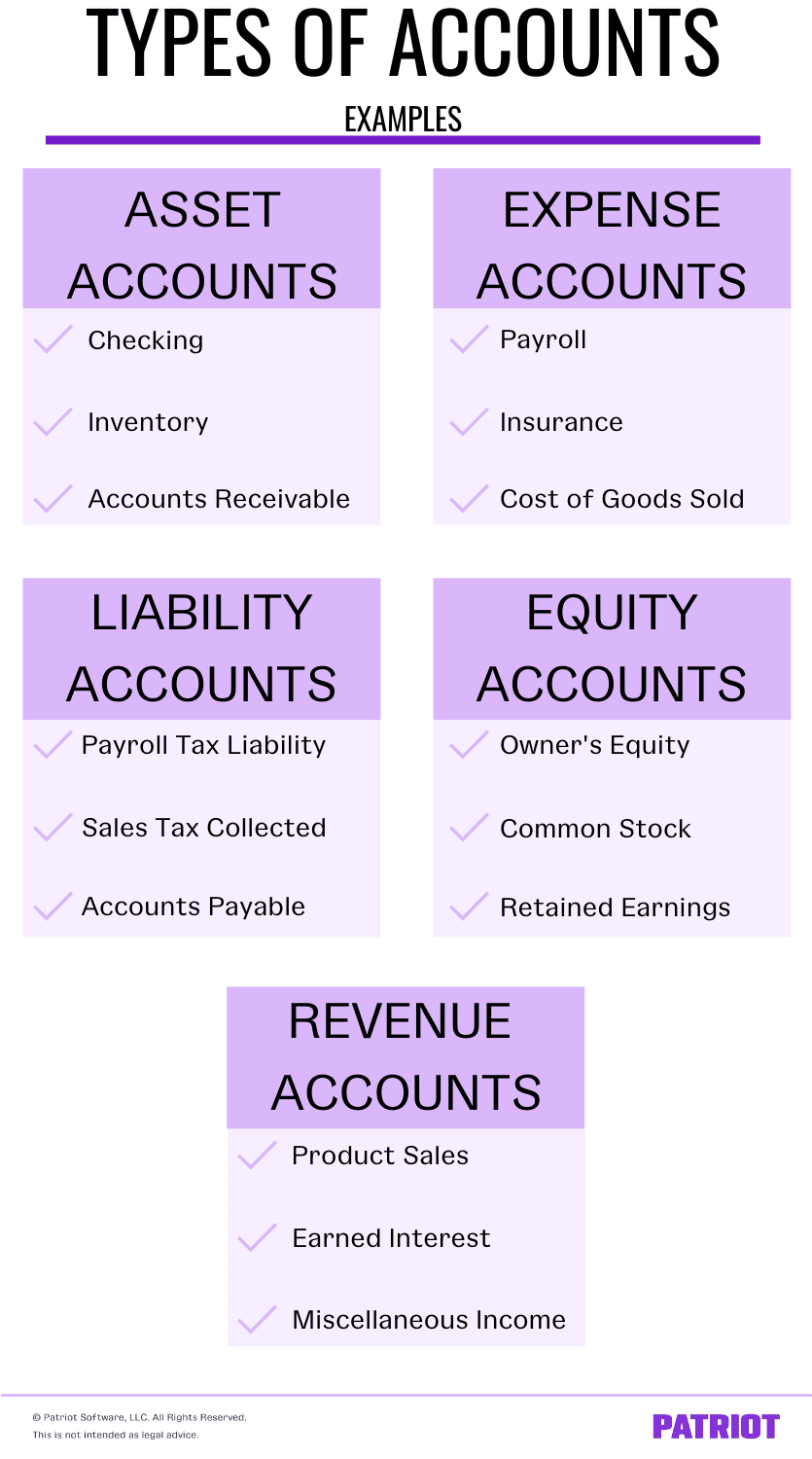

Types Of Accounts In Accounting Assets Expenses Liabilities More

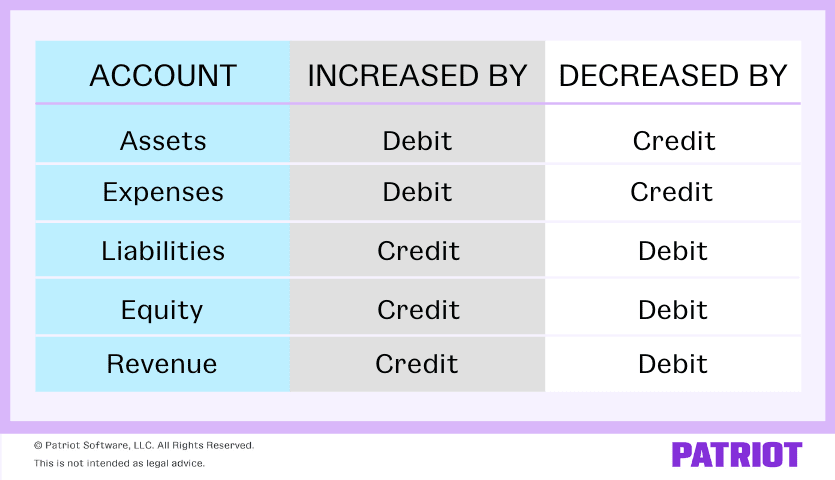

95 rows Account Type Debit Credit.

. The same for the decrease column. A debit decreases the balance and a credit increases the balance. Increase with a debit and decrease with a credit.

Installment and open credit. In bookkeeping revenues are credits because revenues cause owners equity or stockholders equity to increase. So the kind of the accounts where the increase will be reported or recorded by the credits the account would be liabilities and the expenses.

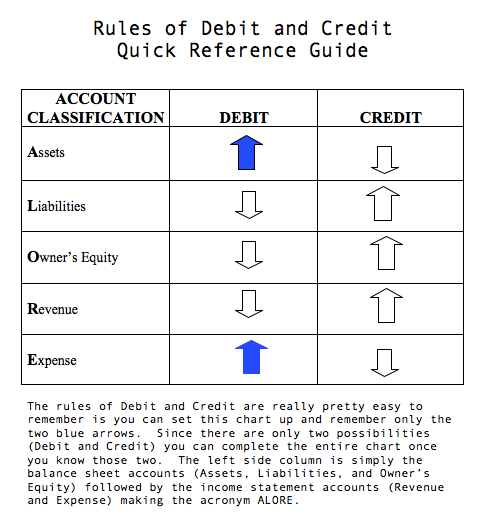

Why revenue is on credit side. Learn with flashcards games and more for free. These differences arise because debits and credits have different impacts across several broad types of accounts which are.

Decrease with a debit and increase with a credit. The journal entry to record the declaration of the cash dividends involves a decrease debit to Retained Earnings a stockholders equity account and an increase credit to Cash Dividends Payable a liability account. Balance sheet accounts.

It comes with an established maximum amount and the. If your limit increased to 4000 your utilization ratio would drop to 25. See the answer See the answer done loading.

Click to see full answer. Generally the following types of accounts are increased with a credit. Installment accounts revolving accounts and open accounts.

2 If you purchased a fixed asset such as a vehicle equipment furniture building. 1 Creating an Invoice or Sales Receipt to a client. Say you make a 200 sale to a customer who pays with credit.

Indicate whether a credit will increase or decrease each of the following accounts. What are the Types of Credit. There are three main types of accounts.

Raising your credit limit decreases your utilization ratio if your balances remain the same. Credits increase liabilities revenues and equity while debits result in decreases. Terms in this set 39 accounts receivable.

Which of the following accounts would be increased with a credit. Through the sale you increase your Revenue account through a credit. A debit increases the balance and a credit decreases the balance.

It is positioned to the left in an accounting entry. A credit is an accounting transaction that increases a liability account such as loans payable or an equity account such as. Decrease with a debit and increase with a credit.

Well show you why having a balanced mix of accounts is important and what each different type of credit account entails. Everything will fall under one of. A debit is an accounting entry that either increases an asset or expense account or decreases a liability or equity account.

Liability revenue and equity accounts each follow rules that are the opposite of those just described. Then type debit or credit within the increasedecrease columns to signify whether a debit increases the account or a credit increases the account. A debit to an asset account could be.

However assets expenses and drawing accounts are considered as having normal debits balance because they increases with recording debit transactions and decreases with. T-accounts a visual aid for seeing the effect of the debit and credit on the two or more accounts. Ad Get Up To 400 When You Open A One Deposit Account With Direct Deposit Of 500 Or More.

These will appear on your credit report as tradelines. These accounts normally carry a credit balance. Increases in liability owners capital and income accounts are recorded using credits whereas declines in asset and expense accounts are recorded using debits.

Increase with a debit and decrease with a credit. A credit is an accounting entry that either increases a liability or equity account or decreases an asset or expense account. And increase your Accounts Receivable account through a debit.

Showing that you can handle different types of creditand multiple credit accounts at onceindicates financial reliability to potential lenders. Decrease revenue accounts with a debit. If you have a 1000 credit card balance on a card with a 2000 credit limit your credit utilization ratio for that account is 50.

Decrease with a debit and increase with a credit. Debit bank account or Undeposited Funds if a Sales Receipt indicating cash received which credits an income account. For the attached table identify the type of account as an asset liability or equity account.

T he three main types of credit are revolving credit. Indicate whether a credit will increase or decrease each of the following accounts. Loss on sale.

The three types of credit accounts include revolving installment and open accounts. Revolving Credit Facility A revolving credit facility is a line of credit that is arranged between a bank and a business. Revenue account is considered as nominal account and having normal credit balance because it decreases with recording debit transactions and increases with recording credit transactions.

Or an Invoice debits Accounts Receivable and credits an income account. Then well give you action-oriented steps to maximize your credit score in this category. Credit balances are common in liability income and the owners capital account because it is how they are increased.

An increase in the following accounts are. Credit is the term which is used in accounting and it is defined as the accounting entry which either increase the liabilities and the equity or decreases the assets on the balance sheet of the company or firm. Bank Whenever You Want From Wherever Your Want With Online Banking Or Our Mobile App.

Credit utilization works something like this. Assets - debits Liabilities - credits Capital - credits Revenue - capital Expenditure - debit.

Types Of Accounts In Accounting Assets Expenses Liabilities More

Accounts Debits And Credits Principlesofaccounting Com

No comments for "Which Type of Account Is Increased With a Credit"

Post a Comment